Improving tax compliance through public disclosure: Evidence from Uganda

Although property taxes are a major revenue source for Kampala Capital City Authority, compliance challenges persist. A study on public disclosure of tax behaviour reveals that recognising compliant taxpayers unexpectedly reduces overall compliance with enforcement reminders proving more effective at improving compliance.

Property taxes are an important potential source of revenue for cities. Faced with limited municipal revenues and rapidly growing populations, taxes on the value of land and property can offer a significant source of funding for cities to provide local services and to finance larger investments. In Kampala, property rates are the single largest contributor of own source revenues, accounting for over 38% of own source revenues in 2019-20 according to the Kampala Capital City Authority (KCCA) Directorate of Revenue Collection

Compliance with this tax, however, is weak in many low-income country cities, and Kampala is no exception. Only 12% of billed properties paid their rates on time in 2019-20, resulting in only 34% of potential revenue being raised (based on author calculations).

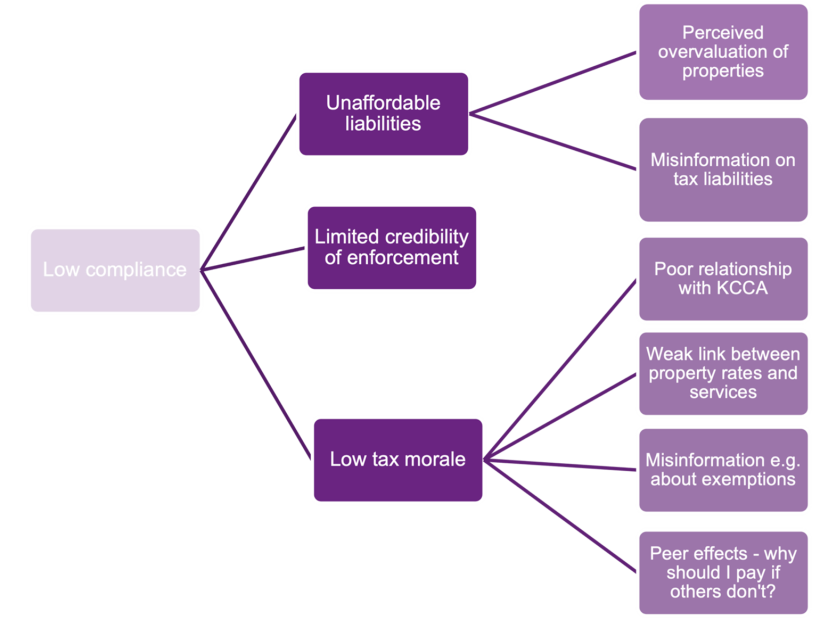

A study involving Focus Group Discussions (FGDs) and a baseline survey was conducted with 1,000 taxpayers in 2020. The results highlight several reasons that can explain the low compliance in Kampala, summarised in Figure 1 below.

Figure 1: Reported issues with property rate payments in Kampala

Testing public disclosure

In this context, we studied the impact of a common policy tool aimed at raising tax compliance: public disclosure of tax behaviour. Despite mixed evidence on the effectiveness of public disclosure policies, many governments use these kinds of ‘shame’ or ‘honour’ lists to try to promote tax compliance. In fact, the OECD ranks shaming as the fourth most used instrument of enforcing tax debt. This places it behind procedures like obtaining liens on assets, initiating bankruptcy, or imposing liability on company directors for tax debts. It also surpasses actions like temporarily closing businesses, restricting access to government services, and imposing travel restrictions. Accordingly, the Uganda Revenue Authority (URA) annually honours the largest corporate income taxpayers by district and across the country.

We compared the relative effectiveness of two disclosure methods: publicly reporting tax delinquents and publicly honouring tax compliers. We ran the experiment over two years, which allowed us to examine how these disclosures impact compliance through two different avenues:

- In year-1 (FY 2020-21), taxpayers were warned that lists of compliers and non-compliers would be made public. This allows us to examine a direct effect: do taxpayers change their compliance behaviour when they know that it will be publicised?

- In year-2 (FY 2021-22), these lists were publicised. This allows us to look at a knock-on effect: do taxpayers change their behaviour when they are publicly notified of the behaviour of others?

Key findings

There are five key takeaways from our experiment:

- We find positive direct effects of the threat of public reporting on compliance, which raises the probability of tax payment by 19% - the likelihood of tax payments being made increases when individuals are alerted about potential public reporting. However, this is almost exactly counterbalanced by negative knock-on effects of this disclosure: when individuals are notified of delinquent behaviour, they become less likely to comply themselves. Putting these two effects together, we would expect this policy to have a very small but negative effect on tax compliance if rolled out.

- Interestingly, the recognition of compliant taxpayers also backfires in this context, with both direct and knock-on effects of recognition reducing compliance by 17%. These results are consistent with a model of behaviour in which taxpayers overestimate the true compliance rate, and being publicly known as tax-eligible is costly but social sanctions for delinquency are limited.

- Instead, a simple message communicating potential enforcement measures raises compliance by 35% - and does not share the negative ‘backfiring’ effects of public reporting. Per shilling spent on messages, enforcement messages raise TZS 25 in additional revenue compared to control messages that only remind taxpayers of their liability and the deadline.

- Other types of information messages that appeal to reciprocity or that provide contact details of government relationship managers have no effect on compliance. This in part reflects public dissatisfaction with the provision of public goods and poor relationship management by KCCA officials. In fact, 60% of taxpayers who tried to contact their relationship managers did not find them to be helpful in addressing their concerns.

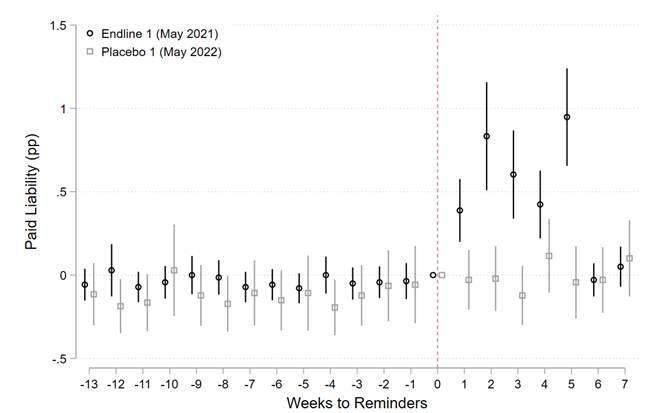

- Examining payment rates before and after the onset of the experiment, it appears that receiving any kind of SMS reminder appears to play a significant role in raising compliance. The notable impact of reminders suggests that substantial information gaps may play a part in low compliance. Complementary evidence from the focus groups and baseline survey indicate considerable misunderstandings, especially concerning tax due dates.

Policy reflections

Our findings suggest three key policy implications for raising compliance in this setting:

- Sending out SMS messages to taxpayers plays an important role in raising compliance. In particular, sending simple messages outlining potential enforcement measures appears to be a cost-effective way of raising compliance.

- There is a clear need to further develop the relationship between taxpayers and the city, through dedicated client managers and public service delivery. By linking the payment of taxes to tangible benefits for citizens, the city can encourage longer term improvements in tax compliance.

- Addressing information gaps through taxpayer sensitisation and data audits can be a low hanging fruit for maintaining compliance over time. Evidence from our focus groups, surveys, and experiment reveals significant information gaps among taxpayers on tax liabilities and obligations, determination methods, and payment deadlines and processes.