How Zambia can leverage mobile money to increase tax revenue

The past 15 years have seen a huge boom in the uptake of mobile money services in Zambia. The Zambia Revenue Authority (ZRA) could leverage data from these mobile money providers to make existing taxes work better and generate tax revenues more efficiently.

From January 2024, a new mobile money levy came into effect in Zambia. This levy aims to capitalise on the dramatic growth in mobile money transactions to indirectly tax the formal and informal economies.

Is the e-levy the best way of using mobile money to increase tax revenues? Could it not dampen economic growth, further decreasing tax returns?

One of the reasons behind low tax revenues is the lack of consistent third-party information for tax enforcers to use. In the informal economy the lack of third-party information is even more exacerbated.

Considering these possibilities, we examine why Zambia struggles to raise tax revenues, how mobile money levies have panned out in other contexts, and how the Zambia Revenue Authority (ZRA) can make the most of it by using mobile money data to act as a third-party reporting tool instead to support existing mechanisms for tax enforcement.

Why Zambia struggles to raise tax revenue?

Zambia’s relatively low tax to GDP ratio of 16% places pressure on the government to fund public services that contribute to economic growth. Increasing tax revenue is important to make Zambia more self-sufficient. Yet, Zambia struggles to raise tax revenue. Two reasons include:

1. The lack of consistent third-party reporting. Third-party reporting is often one of the most important factors in tax collection, as it makes it easier for enforcers to track economic activity. For example, when a consumer purchases a good with a bank card, a paper trail of that purchase is created. Tax officials can then use this paper trail to determine how much revenue they can expect to collect. Without good third-party reporting it becomes burdensome for the ZRA to enforce existing taxes.

2. The large informal economy. Most people work in the informal sector that makes up 38% of the GDP. However, the informal economy generates no direct taxes - since the ZRA doesn’t get Personal Income Tax (PIT) from most people within the country. However, due to little third-party information on informal transactions and low profit margins from many informal enterprises, it further struggles to directly tax the informal economy.

The expansion of mobile money services could help the ZRA deal with both constraints.

Could a mobile money levy increase tax revenue?

Mobile money providers such as Airtel have experienced a massive boom in Zambia and are popular in both the formal and the informal economy. In 2023, 56% of all retail payments were made with mobile money while in the informal economy 34% of workers were paid with mobile money. Mobile money is popular among the informal economy as it has decreased the cost of accessing financial services, such as lending, saving, and sending money. Due to its popularity in the informal economy, it could be used to increase tax revenues from the informal economy in the long term.

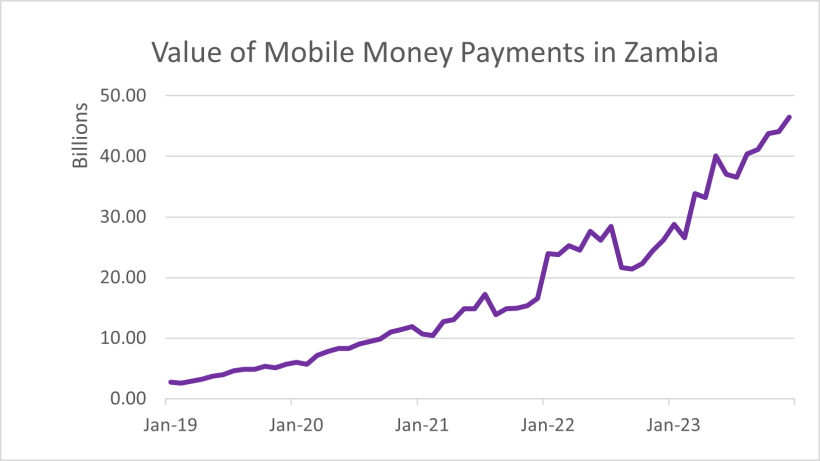

Figure 1: Mobile Money payments since 2021 in Zambia

The ZRA have seen the popularity of mobile money as an opportunity to raise revenues through a tax on transactions. In January 2024, an e-levy was introduced to generate indirect taxes from both the formal and informal economy. The levy is based on the size of the transaction and has eight categories, but is still relatively low compared to other countries. However, the e-levy may not be the most appropriate way of using mobile money services to raise tax revenues.

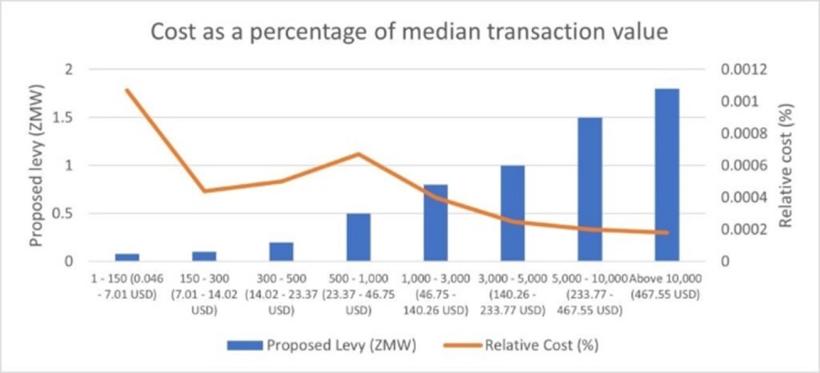

Firstly, the e-levy could be regressive - lower income people might pay a large share of their income to the tax. The levy is proportionally larger for smaller transactions (as seen in Figure 2). Therefore, if people cannot afford to make singular big payments, they may end up paying more tax cumulatively. For example, if a person paid US$ 2 through mobile money twenty times (totalling US$ 40), they would have paid three times as much in the levy than if they just paid for a single US$ 40 transaction. Therefore, while the levy may be raising tax revenue, it is at the expense of the citizens who cannot afford to make large singular purchases.

Figure 2: Cost of the proposed levy as a percentage of the median transaction value within each rate band (ZMW = Zambian Kwacha)

Secondly, similar e-levies have been found to actually slow down economic growth leading to decreased tax revenues. In Ghana, an e-levy was introduced in 2022, which not only was found to be regressive but also led to a loss in tax revenues. Many mobile money users switched back to cash due to the higher transaction costs that led to decreased economic activity and almost GHS 1.4 billion of tax revenue being lost.

While it is too early to tell whether the e-levy in Zambia will lead to a decrease in economic activity, there is a better way of utilising mobile money services to increase tax revenue.

How Zambia can use mobile money to increase tax revenues

The real benefit of mobile money in raising tax revenue is not via taxing but via information. In high-income countries high frequency data from banks is used as third-party information for tax enforcement. Considering that more than half of retail transactions in Zambia are paid for by mobile money, there is a huge paper trail which the ZRA could use to better enforce existing taxes. They could also use the information to spot informal firms which could pay taxes but choose to avoid them.

Furthermore, using mobile money data in tax enforcement would be in line with wider digitalisation steps the ZRA have been taking. In 2024, the ZRA announced that they will be using a new ’smart’ invoicing system which will digitalise the whole process of paying taxes. Moreover, the new Bulk Intelligence Data Analytics programme has also made it easier to digitalise and enforce tax compliance. Including mobile money data in these datasets is a natural step for the ZRA to take and will further provide more information where tax evasion is occurring in both the formal and informal economies.

Utilising mobile money data in tax enforcement can increase tax revenues

Zambia struggles to raise tax revenue, which is needed to fund basic public services. The lack of consistent third-party reporting and a large informal sector hinders tax collection. Thus far, the emphasis has been on taxing mobile money transactions. However, such taxes have been found to be regressive and could lead to a decrease in tax revenues. Therefore, including mobile money data in tax enforcement is a natural step for the ZRA to take and could generate third-party information and identify areas that could be taxed in the informal sector.

You can learn more about tax by revisiting the International Conference on Tax for Growth, or by visiting our Tax for Growth initiative.